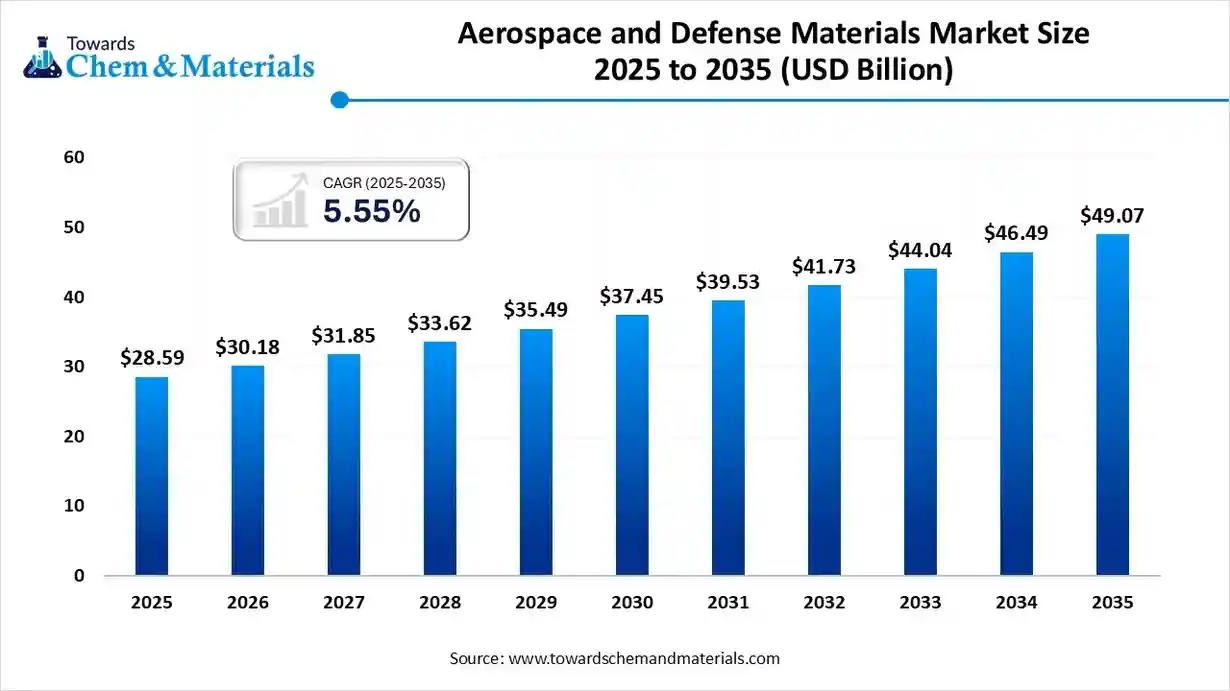

Aerospace and Defense Materials Market Size to Worth USD 49.07 Bn by 2035

According to Towards Chemical and Materials Consulting, the global aerospace and defense materials market size valued at USD 28.59 billion in 2025 and is expected to be worth around USD 49.07 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.55% over the forecast period from 2026 to 2035.

Ottawa, Nov. 28, 2025 (GLOBE NEWSWIRE) -- The global aerospace and defense materials market size was valued at USD 28.59 billion in 2025. The market is projected to grow from USD 30.18 billion in 2026 to USD 49.07 billion by 2035 at a CAGR of 5.55% during the forecast period. North America dominated the Aerospace and Defense Materials market with a market share of 50.19% in 2025. The aerospace and defense materials market is primarily driven by rising demand for lightweight, high-performance materials that enhance fuel efficiency, structural durability, and overall mission capability in both commercial and military aircraft. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6029

What are Aerospace and Defense Materials?

The aerospace and defense materials market is expanding steadily as aircraft modernization, defense upgrades, and increased production of advanced commercial and military platforms drive demand for high-performance materials. Lightweight composites, high-temperature alloys, and advanced ceramics are increasingly adopted to improve fuel efficiency, structural strength, and mission endurance. Growth is further supported by rising investments in next-generation technologies such as hypersonics, unmanned systems, and space exploration, all of which require materials with exceptional durability, thermal resistance, and reliability.

Additionally, sustainability initiatives are encouraging the development of recyclable composites and environmentally friendly manufacturing processes, reshaping material innovation across the sector.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Aerospace and Defense Materials Market Report Highlights

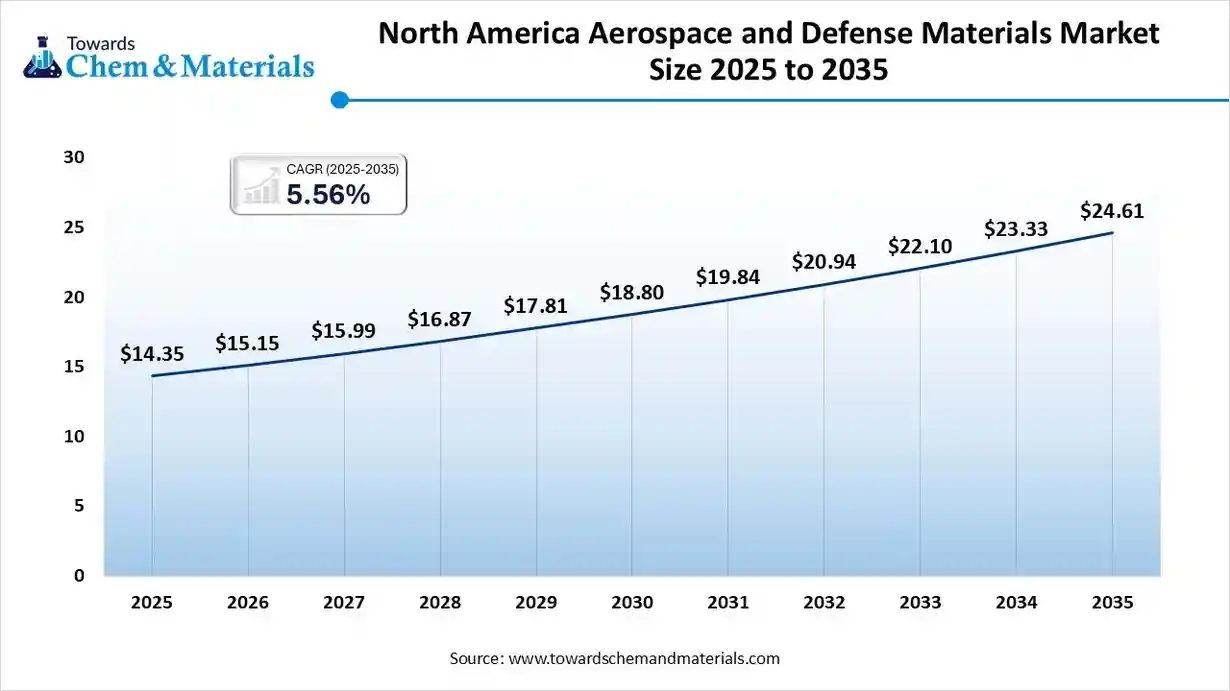

- North America dominated the aerospace and defense materials market with a revenue share of 50.19% in 2025.

- By material type, the metals & alloys segment led the market and accounted for 45% of the global revenue share in 2025.

- By aircraft type, the commercial aircraft segment accounted for the largest revenue share of 44% in 2025.

- By property, the lightweight & high strength materials segment dominated with the largest revenue share of 42% in 2025.

- By end-use sector, the commercial aviation OEMs segment dominated the market and accounted for the largest revenue share of 37% in 2025.

- By distribution channel, the direct supply segment accounted for the largest market revenue share of 55% in 2025.

The Role of Advanced Materials in Aerospace

Aircraft and spacecraft are subject to extreme operational conditions, including high temperatures, intense pressures, and exposure to corrosive elements. While often lightweight and relatively strong, traditional materials such as aluminum often lack the durability required for high-performance aerospace applications. Advanced materials address these challenges by offering superior mechanical properties while maintaining low weight, improving overall efficiency and reliability.

For a material to be considered viable for aerospace applications, it usually must possess a high strength-to-weight ratio, ensuring aircraft remain lightweight while maintaining structural integrity. Thermal and corrosion resistance are other essential characteristics, as aerospace materials must endure extreme temperatures and exposure to oxidation and other environmental factors. Additionally, flight hardware experiences repeated stress cycles, necessitating materials with exceptional fatigue and fracture resistance to prevent catastrophic failures. Despite these demanding requirements, materials must also be manufacturable and cost-effective, allowing for large-scale production while maintaining affordability.

Three of the most prominent types of advanced materials—composites, superalloys, and titanium alloys—are revolutionizing aerospace engineering.

The Bottom Line on Metals in the Aerospace and Defense Industry

The aerospace and defense industry depends on exotic and refractory metals and alloys to meet the stringent demands of modern air travel, space exploration, marine and defense systems. From commercial aviation and space tourism to military applications, missiles, and unmanned systems, these materials provide the essential properties that enable high performance, safety, reliability, and formability.

Why the A&D Industry Buys Rare and Exotic Metals

- Durability: High resistance to wear and corrosion extends the lifespan of components.

- Efficiency: High-performance metals improve energy conversion and reduce losses.

- Safety: Robust materials ensure operational safety in extreme conditions.

- Formability: Ability to be molded or fabricated into precise shapes and complex components without cracking or losing their desirable properties to meet the rigorous standards and demands of the industry and ensure optimal performance and safety in flight and space missions.

Key A&D Materials We Offer

- INVAR®: Nickel and iron alloy with very low thermal expansion, used extensively for precision optical instruments and for tooling in the commercial aviation sector. Explore INVAR® 36

- KOVAR®: A nickel-cobalt alloy with unique thermal expansion properties matching borosilicate glass for excellent structural integrity and resistance to thermal stresses. Widely used in electronic packaging. Explore KOVAR®

- Tungsten: Used widely across the aerospace and defense industry because of its high density, hardness, corrosion resistance, and heat resistance, especially in counterweight and harsh exposure applications. Explore Tungsten

- Niobium: Excellent formability, low density, high heat resistance, and protection against extreme thermal environments. Explore Niobium

- Molybdenum: High strength and thermal conductivity, perfect for withstanding high temperatures without deforming, especially in applications like missile and weapon systems. Explore Molybdenum

- Titanium: Exceptional strength-to-weight ratio and resistance to fatigue and corrosion make this material common across aerospace and defense sectors to improve fuel efficiency and maneuverability in applications like airframes, landing gear, engine components, and heat shields. Explore Titanium

-

Nickel Alloys: Superior resistance to oxidation and corrosion at elevated temperatures makes this a common material in space systems and other applications across aerospace and defense sectors. Explore Nickel Alloys

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6029

Aerospace & Defense Materials Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 30.18 billion |

| Revenue forecast in 2035 | USD 49.07 billion |

| Growth rate | CAGR of 5.55% from 2026 to 2035 |

| Base year for estimation | 2025 |

| Actual estimates/Historical data | 2018 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2035 |

| Report coverage | Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regional Scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Czech Republic; China; India; Japan; Australia; South Korea; Brazil; South Africa |

| Segments covered | By Material Type, By Aircraft / Platform Type, By Property / Material Performance Requirement, By End-Use Sector, By Distribution Channel, By Region |

| Key companies profiled | Huntsman International LLC; Toray Composites America, Inc.; VSMPO-AVISMA; Arconic Inc.; Kobe Steel, Ltd.; Allegheny Technologies; Cytec Solvay Group; Hexcel Corporation; Novelis; Constellium N.V.; SGL Carbon; thyssenkrupp Aerospace; Formosa Plastics Corporation, U.S.A.; Strata Manufacturing PJSC; Teijin Limited |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Future Trends: Next-Generation Aerospace Materials

While composites and titanium dominate today’s aerospace industry, new materials are emerging to push the boundaries of performance further. Ceramic matrix composites (CMCs) offer extreme heat resistance, making them suitable for hypersonic aircraft and spacecraft reentry systems. These materials are increasingly used in turbine blades and thermal protection systems.

Graphene and other nanomaterials are also being explored for aerospace applications due to their ultra-lightweight yet highly durable properties. These advanced materials are potential game-changers for satellite structures and next-generation aircraft skins. Another exciting development over the horizon is using shape memory alloys (SMAs), which can change shape when exposed to temperature variations. SMAs could enable se

AI is Reshaping the Aerospace and Defense Materials Industry:

AI is transforming the aerospace and defense materials industry by accelerating material discovery, enabling engineers to simulate performance outcomes and optimize formulations in a fraction of the traditional time. Machine learning models are enhancing predictive maintenance and structural health monitoring, helping manufacturers design materials that last longer under extreme conditions. AI-driven digital twins are reshaping testing processes by simulating stress, fatigue, and thermal behavior, reducing prototyping costs and shortening development cycles.

Government Initiatives for the Aerospace and Defense Materials Industry

- Innovations for Defence Excellence (iDEX) (India): This initiative encourages startups and MSMEs to innovate for defense needs by offering grants and procurement support, which helps drive the development of advanced materials.

- Aerospace Technology Institute (ATI) (UK): The ATI is a unique collaboration between industry and the UK government that co-funds research and development projects to secure the UK's position in the global aerospace market, including investments in advanced materials like composites.

- European Defence Fund (EDF) (EU): The EDF provides funding for collaborative defense research and development (R&D) projects across EU Member States, with dedicated portions allocated to disruptive technologies and new advanced materials for future defense capabilities.

- CHIPS and Science Act (US): This U.S. government program provides incentives and funding for the production and innovation of semiconductor chips, which are critical components and materials in the aerospace and defense supply chains.

-

Defence Production and Export Promotion Policy (DPEPP) 2020 (India): This policy aims to develop a robust domestic defense industrial ecosystem, including materials production, by promoting indigenous manufacturing and setting high export targets

Key Trends of the Aerospace and Defense Materials Market

- Shift Toward Lightweight Materials: This trend is driven by the need to increase fuel efficiency, reduce operational costs, and meet stringent environmental regulations. Materials like advanced composites and titanium alloys provide superior strength-to-weight ratios compared to traditional metals.

- Increased Adoption of Additive Manufacturing: 3D printing allows for the creation of complex parts with less material waste and shorter production lead times. This technology also improves supply chain resilience by enabling on-demand spare part manufacturing.

-

Growing Focus on Sustainability and Resilience: The industry is increasingly emphasizing eco-friendly materials to reduce its carbon footprint and meet global sustainability goals. Geopolitical factors also drive efforts toward localizing supply chains to ensure a stable and secure material flow.

Market Opportunity

Ultra-Lightweight Composites: The Next Big Leap in Defense Innovation

A major opportunity in the aerospace and defense materials market lies in the rapid expansion of ultra-lightweight, high-strength composite materials that significantly enhance fuel efficiency, mission endurance, and payload capacity. As defense forces and aerospace manufacturers push for faster, stealthier, and more energy-efficient platforms, the demand for advanced carbon-fiber composites, nanocomposites, and hybrid materials is accelerating sharply.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6029

Aerospace and Defense Materials Market Segmentation Insights

Material Type Insights

In 2025, the metals & alloys segment dominated the market due to their critical role in manufacturing high-strength, durable, and heat-resistant components for aircraft, spacecraft, and defense systems. Titanium, aluminum, and superalloys were in high demand for lightweight structures, engine parts, and airframe components, meeting the dual needs of performance and fuel efficiency. Rising commercial aviation production and advanced military programs drove large-scale adoption of these materials across global OEMs and defense contractors.

The due to their exceptional strength-to-weight ratio, which is critical for improving fuel efficiency and performance in aircraft and spacecraft. Carbon fiber-reinforced polymers, glass composites, and other advanced materials were increasingly adopted for airframes, wings, and fuselage components in commercial and defense applications. The growth of next-generation aircraft, reusable launch vehicles, and unmanned systems accelerated demand for lightweight, durable, and corrosion-resistant composites. segment is expected to grow fastest over the forecast period

Aircraft / Platform Type Insights

The commercial aircraft segment led the market in 2025 due to surging global air travel demand and accelerated fleet expansion by major airlines. Large OEMs increased production of next-generation aircraft, boosting the need for advanced composites, alloys, and lightweight materials. Fuel-efficiency regulations further pushed manufacturers to adopt high-performance materials that reduce weight and improve operational economics. Continuous innovation in wing structures, cabin components, and engine materials also strengthened demand in the commercial aviation sector.

The spacecraft & launch vehicles segment is the fastest growing segment due to unprecedented growth in commercial space activities and satellite deployment programs. Rising investments from private space companies drove strong demand for ultra-lightweight composites, heat-resistant alloys, and radiation-tolerant materials. The push for reusable launch systems further accelerated adoption of high-durability materials that withstand extreme thermal and mechanical stress.

Property / Material Performance Requirement Insights

The lightweight & high strength materials segment led the market in 2025 because aircraft and defense platforms increasingly prioritized weight reduction to improve fuel efficiency and mission performance. OEMs accelerated the integration of carbon fiber composites, titanium alloys, and advanced polymers to meet stringent efficiency and sustainability standards. Rising production of next-generation commercial aircraft and reusable launch systems further amplified demand for materials that offer superior strength-to-weight ratios.

The high-temperature & thermal-resistant materials segment is projected to grow fastest over the forecast period because advanced aircraft, spacecraft, and hypersonic systems required materials capable of withstanding extreme heat and mechanical stress. Growing development of hypersonic weapons and next-generation propulsion systems significantly increased demand for ultra-heat-resistant ceramics, superalloys, and thermal-protection composites. Space exploration programs, including reusable launch vehicles, relied heavily on materials that maintain structural integrity during intense re-entry temperatures.

End-use Sector Insights

In 2025, the commercial aviation OEMs segment led the market due to the rapid rebound in global air travel and the resulting surge in aircraft production rates. Major manufacturers focused on delivering backlogged orders for fuel-efficient and next-generation aircraft, driving high demand for advanced composites, titanium, and lightweight alloys. Stricter sustainability and emission standards pushed OEMs to integrate more cutting-edge materials that enhance fuel efficiency and reduce environmental impact.

The space agencies & private space companies’ segment is the second-largest segment, leading the market due to the rapid expansion of satellite constellations, deep-space missions, and reusable launch vehicles. Rising investments in commercial space exploration by companies like SpaceX, Blue Origin, and national space agencies drove strong demand for advanced lightweight composites, high-strength alloys, and thermal-resistant materials. The development of hypersonic and reusable propulsion systems further increased the need for materials that can endure extreme temperatures and mechanical stresses.

Distribution Channel Insights

The direct supply segment dominated the market in 2025 because manufacturers increasingly preferred sourcing materials directly from producers to ensure quality, consistency, and timely delivery. Direct supply allowed OEMs and defense contractors to access advanced composites, high-strength alloys, and thermal-resistant materials tailored to specific aerospace applications. Rising production rates in commercial aviation and space exploration heightened the need for reliable supply chains, reducing dependency on intermediaries.

The specialized material service centers segment is expected to lead the market over the forecast period due to their ability to provide customized processing, cutting, and value-added services tailored to complex aerospace applications. These centers offered precision solutions for high-performance alloys, composites, and thermal-resistant materials, enabling faster integration into aircraft, spacecraft, and defense systems. Growing demand for lightweight, high-strength, and heat-resistant materials in commercial and defense projects increased reliance on service centers for on-demand, ready-to-use material formats.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

North America Soars: Dominating the Aerospace and Defense Materials Market

The North America aerospace and defense materials market size was valued at USD 14.35 billion in 2025 and is expected to reach USD 24.61 billion by 2035, growing at a CAGR of 5.56% from 2026 to 2035. North America dominated the market with approximately 50.19% share in 2025.

North America maintained its dominance in the market in 2025, driven by the presence of leading aircraft and defense OEMs, robust R&D infrastructure, and strong government defense spending. The region’s advanced manufacturing capabilities and early adoption of high-performance materials, including composites, superalloys, and thermal-resistant solutions, bolstered its competitive edge. Continuous investments in next-generation commercial aircraft, reusable launch vehicles, and defense modernization programs fueled sustained material demand.

Canada Aerospace and Defense Materials Market Trends

Canada’s market in 2025 showed steady growth, fueled by its strong aerospace manufacturing base and defense modernization programs. The country’s focus on advanced materials, including lightweight composites, high-strength alloys, and thermal-resistant solutions, supported both commercial aircraft production and defense applications. Collaborative projects with global OEMs and research institutions facilitated innovation in next-generation aircraft, UAVs, and satellite technologies. Increasing government investments in sustainable aviation initiatives and advanced propulsion systems further drove demand for high-performance materials.

Asia-Pacific on the Rise: Fastest-Growing Hub for Aerospace and Defense Materials

The Asia-Pacific region emerged as the fastest-growing market for aerospace and defense materials in 2025, driven by rapid expansion of commercial aviation and defense modernization programs in countries like China and India. Rising investments in domestic aircraft production, satellite launches, and unmanned systems created strong demand for advanced composites, high-strength alloys, and thermal-resistant materials. Government initiatives to boost local manufacturing and adopt cutting-edge aerospace technologies further accelerated material consumption.

India Aerospace and Defense Materials Market Trends

India’s market in 2025 experienced robust growth, driven by rising defense modernization programs, expanding domestic aircraft production, and increasing investments in space exploration. The government’s focus on “Make in India” initiatives encouraged local manufacturing of high-performance composites, lightweight alloys, and thermal-resistant materials, reducing dependence on imports. Growing commercial aviation demand, coupled with modernization of fighter jets, helicopters, and UAVs, further boosted material requirements.

Europe Aerospace & Defense Materials Market Trends

The aerospace & defense materials market in Europe is experiencing notable growth. European manufacturers, known for their engineering excellence, increasingly focus on developing lightweight, high-strength materials such as carbon fiber composites and titanium alloys. These materials are essential for enhancing fuel efficiency, reducing emissions, and improving the aircraft's overall performance. As airlines and aerospace companies strive for sustainability and operational cost reductions, the demand for these advanced materials continues to rise.

Recent Breakthrough in the Aerospace and Defense Materials Industry

- On November 24, 2025, U.S. lawmakers probe FAA grant delays over aircraft mechanic shortage before Thanksgiving. The legality of delaying grants which previously authorized by Congress has been questioned by Reuters to Federal Aviation Administration Administrator Bryan Bedford.

More Insights in Towards Chemical and Materials:

- Mycelium-Based Building Materials Market Size to Hit USD 3.81 Bn by 2035

- Cork Building Materials Market Size to Hit USD 20.82 Bn by 2035

- Aerospace and Defense Materials Market Size to Surpass USD 49.07 Bn by 2035

- Refractory Material Market Size to Surpass USD 49.68 Bn by 2035

- Advanced Composite Materials Market Size to Surpass USD 102.15 Bn by 2035

- Sustainable Materials Market Size to Hit USD 1078.35 Bn by 2034

- Building Materials Market Size to Reach USD 2.17 Trillion by 2034

- Aerospace Adhesives and Sealants Market Size to Hit USD 3.66 Bn by 2035

- Aerospace Foam Market Size to Exceed USD 13.27 Billion by 2034

- U.S. Aerospace Foam Market Size to Reach USD 6.22 Billion by 2034

- Europe Adhesives and Sealants Market Size to Surpass USD 34.62 Bn by 2035

- Europe Construction Adhesives and Sealants Market Size to Surpass USD 9.39 Bn by 2035

- Asia Pacific Adhesives and Sealants Market Size to Surpass USD 59.50 Bn by 2035

- North America Adhesives And Sealants Market Size to Hit USD 27.50 Bn by 2035

- Aerospace Adhesives and Sealants Market Size to Hit USD 3.66 Bn by 2035

- U.S. Adhesives and Sealants Market Size to Surge USD 17.08 Billion by 2034

- Adhesives and Sealants Market Size to Surpass USD 139.79 Bn by 2035

- Material Informatics Market | AI & Data-Driven Materials Innovation

- Electronic Materials And Chemicals Market Size to Surge USD 136.03 Bn by 2034

- Energy Dense Materials Market Size to Reach USD 211.44 Bn by 2034

- Aluminum Composite Materials Market Size to Reach USD 8.18 Billion by 2034

- Recycled Plastics In Green Building Materials Market Size to Reach USD 12.24 Bn by 2034

- Biomaterials Market Size to Surge USD 526.63 Billion by 2034

- Green Building Materials Market Volume to Reach 1,271.6 Million Tons by 2034

-

Polymer Denture Material Market Size to Hit USD 4.11 Billion by 2034

Top Companies in the Aerospace and Defense Materials Market & Their Offerings:

- Allegheny Technologies: Offers a wide range of advanced materials, including titanium and specialty alloys, for demanding aerospace and defense applications.

- Cytec Solvay Group: Provides a broad portfolio of high-performance composite materials and adhesives for creating lightweight and durable aerospace structures.

- Hexcel Corporation: Specializes in the manufacturing of advanced composites, such as carbon fiber and honeycomb structures, for military and commercial aircraft.

- Novelis: Focuses on providing sustainable and high-strength aluminum products, leveraging its recycling capabilities to supply leading aircraft manufacturers.

- Constellium N.V: Supplies advanced aluminum products, including proprietary alloys, for critical aerospace and defense structural applications.

- SGL Carbon: Is a global leader in developing carbon-based solutions, offering carbon fibers and composite materials for the aerospace industry.

- thyssenkrupp Aerospace: Is a supply chain management and services company that provides raw material management, logistics, and processing for the aerospace industry.

- Formosa Plastics Corporation, U.S.A: Supplies petrochemicals and plastic resins, but is not a direct provider of specialized materials for the aerospace and defense sector.

- Strata Manufacturing PJSC: Is a composite aero-structures manufacturer that develops and produces critical aircraft components for major aerospace manufacturers.

- Teijin Limited: Offers advanced materials, including carbon fiber, prepregs, and composites, for aircraft and other aerospace applications.

Aerospace and Defense Materials Market Top Key Companies:

- Huntsman International LLC

- Toray Composites America, Inc.

- VSMPO-AVISMA

- Arconic Inc.

- Kobe Steel, Ltd

- Allegheny Technologies

- Cytec Solvay Group

- Hexcel Corporation

- Novelis

- Constellium N.V

- SGL Carbon

- thyssenkrupp Aerospace

- Formosa Plastics Corporation, U.S.A

- Strata Manufacturing PJSC

- Teijin Limited

Aerospace and Defense Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Aerospace and Defense Materials Market

By Material Type

- Metals & Alloys

- Aluminum Alloys

- Titanium Alloys

- Steel & Superalloys

- Composites

- Carbon Fiber Reinforced Polymers (CFRP)

- Glass Fiber Composites (GFRP)

- Aramid Fiber Composites (Kevlar)

- Ceramics & Ceramic Matrix Composites (CMCs)

- Elastomers & Rubber Materials

- Adhesives, Sealants & Coatings

By Aircraft / Platform Type

- Commercial Aircraft

- Military Aircraft

- Helicopters

- UAVs / Drones

- Spacecraft & Launch Vehicles

- Naval & Marine Defense Platforms

By Property / Material Performance Requirement

- Lightweight & High Strength

- High-Temperature & Thermal Resistance

- Wear & Corrosion Resistance

- Impact & Ballistic Resistance

- Electrical & EMI Shielding Properties

- Fire-Resistant & Low-Smoke Materials

By End-Use Sector

- Commercial Aviation OEMs

- Defense OEMs

- MRO (Maintenance, Repair & Overhaul)

- Space Agencies & Private Space Companies

- Defense Vehicle Manufacturers (land & naval)

By Distribution Channel

- Direct Supply (OEM Contracts)

- Distributors & Tier-2/Tier-3 Suppliers

- Specialized Material Service Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6029

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.